Navigating the world of banking and financial services can sometimes feel like entering a labyrinth of paperwork and regulations. One such document that often pops up is the Know Your Customer (KYC) form, particularly when you’re dealing with institutions like the State Bank of India (SBI). While it might seem daunting at first glance, understanding the purpose and process behind KYC forms is essential for a smooth and secure banking experience.

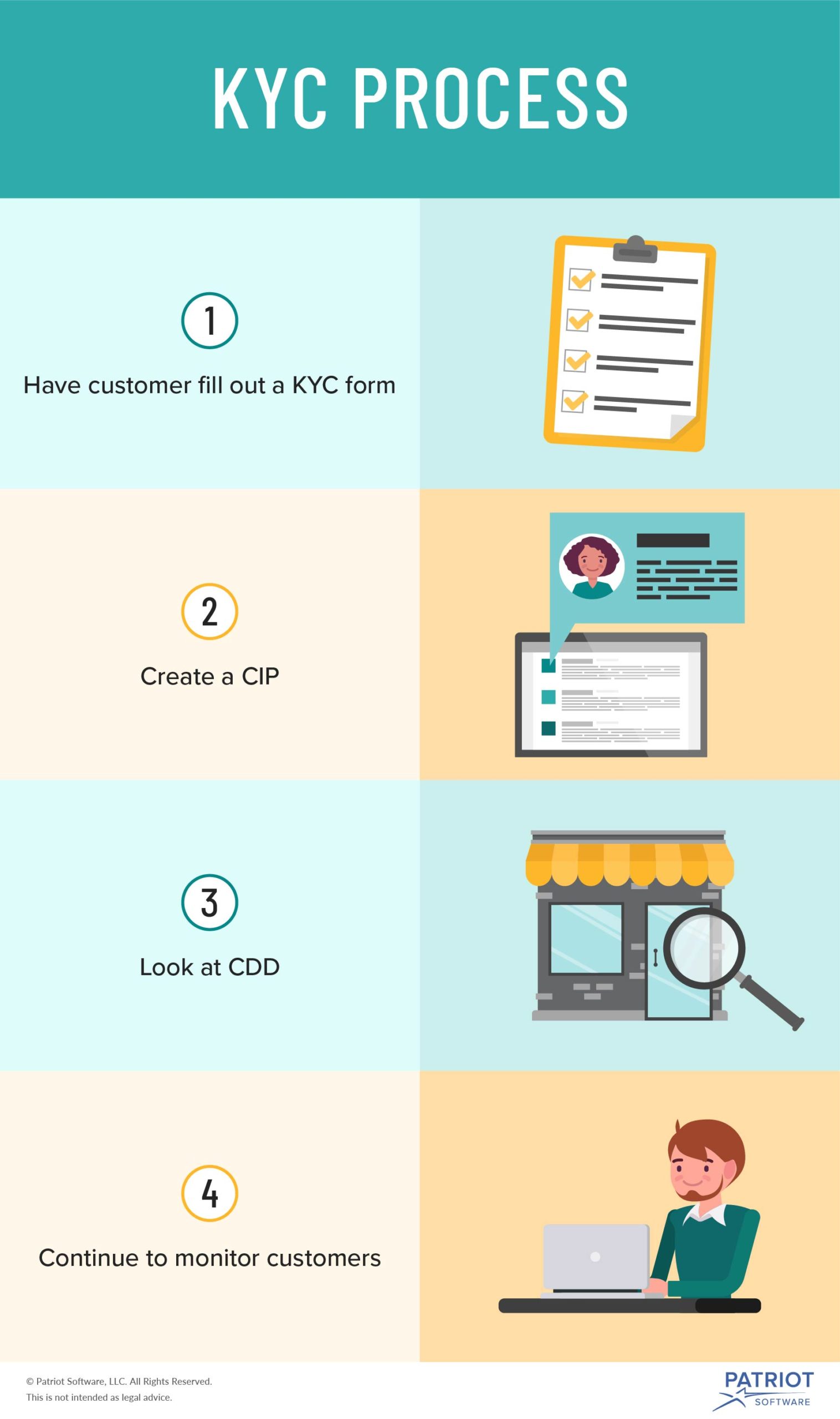

Image: www.patriotsoftware.com

I remember the first time I had to fill out a KYC form. I was opening a bank account and felt overwhelmed by the sheer number of questions. “Why do they need all this information?” I wondered. It wasn’t until I did some research that I realized the critical role KYC plays in ensuring the safety and integrity of the financial system. This article aims to demystify the KYC form and provide you with the essential information you need to navigate it confidently.

Understanding the SBI KYC Form

The Need for Know Your Customer (KYC)

The Know Your Customer (KYC) principle is a cornerstone of financial regulations. Its aim is to identify and verify the identity of customers, preventing fraud, money laundering, and other illicit financial activities. In simpler terms, KYC helps banks and financial institutions know who they are doing business with, ensuring the integrity of their operations.

The KYC process involves collecting and verifying certain essential information from individuals and entities involved in financial transactions. This information helps banks build a profile of their customers, enabling them to assess risk and comply with anti-money laundering laws.

Why SBI Requires KYC Forms

SBI, like all reputable financial institutions, is obligated to follow KYC regulations as mandated by authorities like the Reserve Bank of India (RBI). These regulations require banks to gather and verify information about their customers, helping them prevent financial crimes and ensure a safe and secure banking environment for everyone.

Image: www.sexiezpicz.com

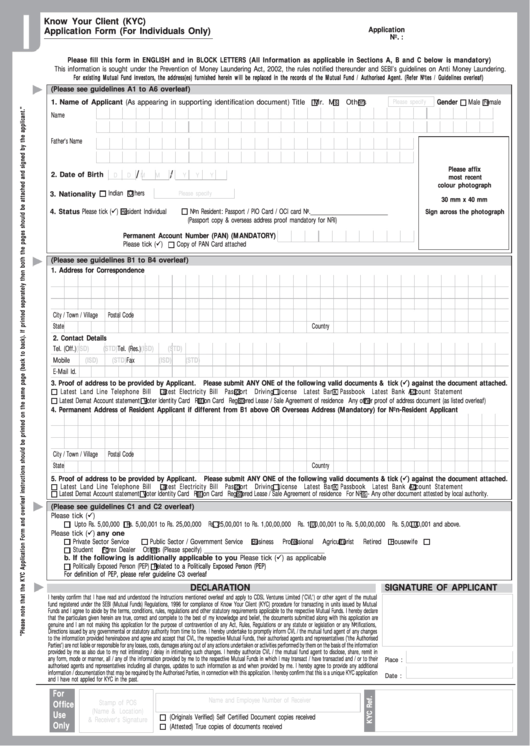

What Information is Included in the SBI KYC Form?

The SBI KYC form typically asks for a range of information, depending on the type of account you’re opening or the service you’re availing. This may include:

- Personal Details: Name, address, date of birth, PAN card details, Aadhaar details, passport details (for foreign nationals).

- Financial Information: Occupation, source of income, account details (if any), bank statements.

- Identity Proof: A government-issued identity document, such as a PAN card, Aadhaar card, Voter ID card, or passport.

- Address Proof: A document that verifies your residential address, such as a utility bill, driving license, or rent agreement.

Types of KYC Verification

SBI uses various methods to verify customer identity, ensuring the information provided is accurate and reliable.

- Physical Verification: This involves physically submitting documents for verification at a bank branch, where staff checks the authenticity of your identity and address proofs.

- Online Verification: With rapid digitalization, SBI offers online KYC verification options, where you can submit scanned copies of your documents electronically through their official website or mobile app. This allows for convenient and faster KYC completion.

- Video KYC: For remote verification, SBI also facilitates video KYC, where you can interact with a bank representative via video call to complete the verification process. You’ll need to present your identity and address proof documents during the call.

Updating Your KYC Information

It’s essential to keep your KYC information up-to-date with SBI. If you change your address, contact details, or other relevant information, inform the bank immediately. Failure to do so can lead to restricted access to your accounts or delays in transactions.

Recent Developments in KYC

The world of finance is constantly evolving, and KYC is no exception. New technologies and regulatory changes continually shape how KYC is implemented and enforced. For example, the use of artificial intelligence (AI) and machine learning is rapidly gaining traction in KYC processes, enabling banks to automate document verification and fraud detection. This automation makes KYC checks more efficient and reduces the time it takes to verify a customer’s identity.

Furthermore, the emergence of digital identity platforms and blockchain technology presents exciting opportunities for streamlining KYC procedures. These platforms offer secure and decentralized methods for verifying identity, potentially reducing the reliance on traditional paper-based processes and improving the user experience. SBI, like many banks, is actively exploring these innovative solutions to enhance its KYC practices and offer its customers even faster and more secure banking services.

Tips for Smooth KYC Completion

To ensure a hassle-free KYC experience with SBI, consider the following tips:

- Gather your documents: Before visiting a bank branch or initiating the online KYC process, collect all the required documents. This includes your identity proof, address proof, and any other documents specific to the account you’re opening or the service you’re availing.

- Double-check the details: Carefully review the information on your documents to ensure accuracy and consistency. Any discrepancy could lead to delays or complications.

- Keep your documents ready for verification: When visiting a bank branch, have your documents arranged and easily accessible. This will streamline the verification process.

- Understand the different KYC methods: Familiarize yourself with various KYC verification methods offered by SBI, such as physical, online, and video KYC. Choose the method most suitable for your situation.

- Stay informed about updates: Keep track of any updates or changes in KYC regulations or procedures announced by SBI. You can find this information on their official website or mobile app.

Expert Advice

As a seasoned blogger, I often encounter individuals who find KYC processes challenging. My advice is to approach them with patience and preparation. Understand that KYC is a necessary security measure to protect your financial well-being and the integrity of the banking system.

If you face any difficulties during the KYC process, don’t hesitate to contact SBI customer support. They’re there to assist you and address any queries you might have. With a little effort and understanding, you can successfully navigate the KYC process and enjoy a seamless banking experience.

FAQ: Know Your Customer Form SBI PDF

Q: What happens if I don’t complete the KYC formalities?

A: If you fail to complete the KYC process, SBI may restrict your access to your bank account or certain banking services. You may not be able to perform transactions like deposits, withdrawals, or online transfers. To avoid any inconvenience, completing KYC is essential.

Q: How often do I need to update my KYC information with SBI?

A: SBI generally requires you to update your KYC information every two years. However, it’s best to check their official website or contact customer support for the most up-to-date guidelines.

Q: Can I get help filling out the KYC form?

A: Yes, bank staff at SBI branches are available to guide you through the KYC form. You can also refer to the form’s instructions or seek assistance from bank representatives via phone or online chat.

Know Your Customer Form Sbi Pdf

Conclusion

The Know Your Customer form plays a vital role in maintaining the safety and integrity of the banking industry. While it may seem like an administrative hurdle, understanding the purpose and process behind KYC is essential for everyone involved in financial transactions. By familiarizing yourself with the SBI KYC guidelines, gathering your documents, and staying informed about updates, you can navigate the process smoothly and enjoy a secure and reliable banking experience.

Are you interested in learning more about KYC practices or have any other questions about SBI banking services? Feel free to ask in the comments section below!