Remember that time I desperately needed a car, but my credit score was less than stellar? I was stuck. Traditional car loans seemed impossible, and I didn’t want to get stuck with a lemon from a “Buy Here, Pay Here” lot. Then, I stumbled upon lease-to-own options. It was a game-changer! A lease-to-own car contract template helped me understand the terms, and I finally got the vehicle I needed. Today, I’m sharing what I learned about lease-to-own contracts and providing you with the tools to make an informed decision about your next car purchase.

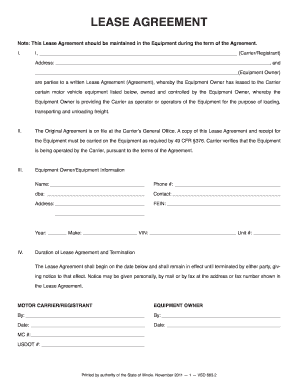

Image: www.uslegalforms.com

Navigating the world of car buying can be daunting, especially when traditional financing options seem out of reach. Lease-to-own arrangements provide an alternative path to car ownership, but it’s crucial to understand the nuances of these contracts. A well-crafted lease-to-own car contract template can set the stage for a successful and transparent agreement between you and the seller. It can help you avoid potential pitfalls and ensure a smooth transition to ownership.

Understanding Lease-to-Own Contracts: A Comprehensive Overview

A lease-to-own car contract is a specialized financing agreement where you lease a vehicle with the intention of purchasing it at the end of the lease term. Unlike traditional leases, where you return the car at the end of the term, lease-to-own arrangements let you buy the car for a pre-determined price, often called the “purchase option.”

These contracts are often attractive to buyers with less-than-perfect credit or limited financial resources. They provide a path to car ownership that might otherwise be unavailable. However, it is essential to understand the intricacies of these agreements before signing on the dotted line.

Key Components of a Lease-to-Own Contract

A comprehensive lease-to-own car contract should include the following key elements:

- Vehicle Description: This section should clearly outline the make, model, year, VIN, mileage, and any other important details about the vehicle.

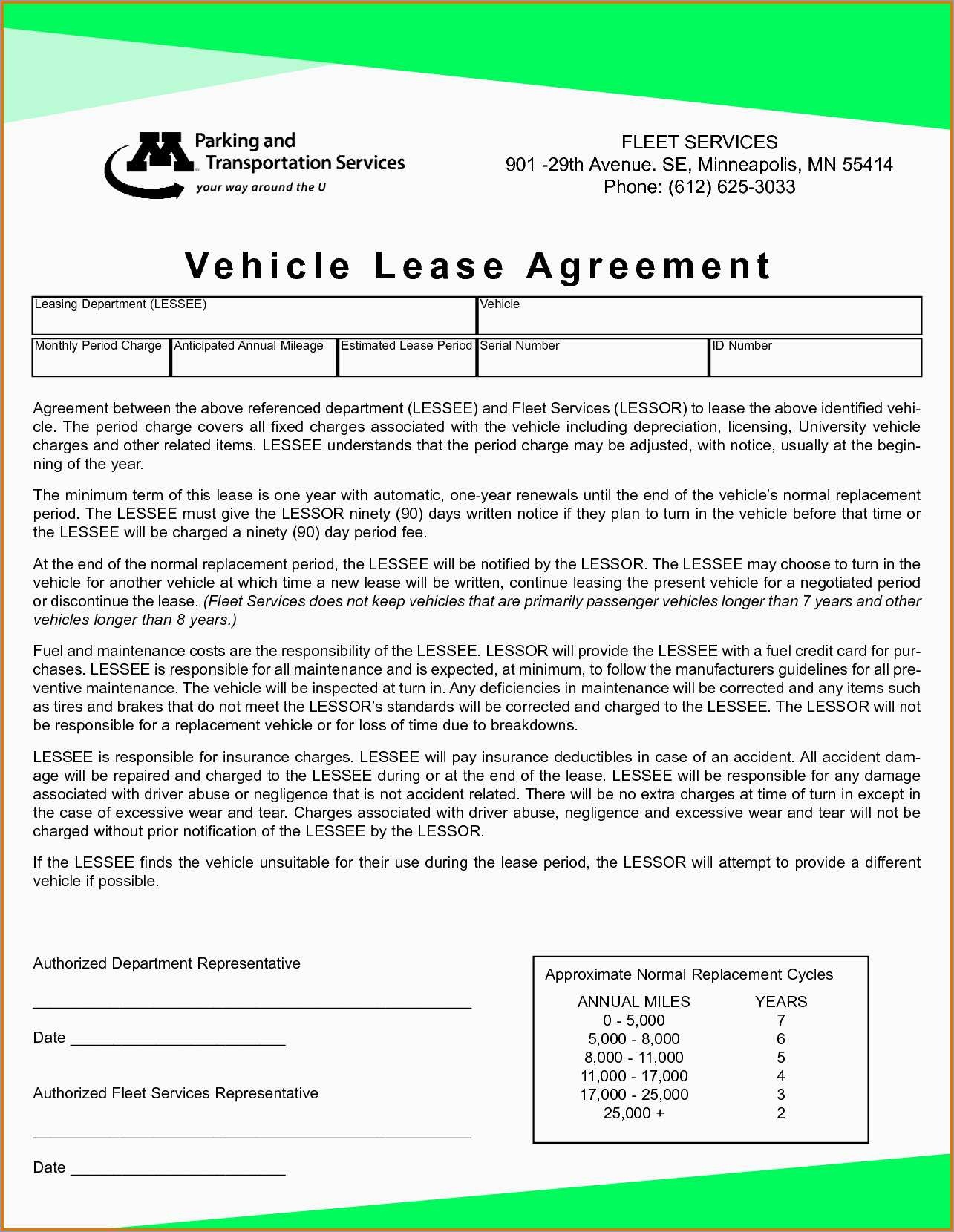

- Lease Term: The contract should specify how long you’ll be leasing the vehicle before you can purchase it.

- Monthly Payments: The contract should clearly outline your monthly payment amount, due date, and any late payment fees.

- Purchase Option Price: This is the price you will pay to buy the car at the end of the lease term. It’s crucial to understand how this price is determined and if it’s fair compared to market value.

- Down Payment: The contract should state any down payment required at the start of the lease.

- Maintenance and Repair Responsibility: It’s important to clearly define who is responsible for maintaining and repairing the vehicle during the lease term.

- Insurance Requirements: The contract should specify the minimum insurance coverage you are required to carry on the vehicle.

- Early Termination Clause: This clause outlines what happens if you decide to end the lease before the purchase option is exercised.

- Default Clause: This clause explains the consequences of not making payments or failing to meet the terms of the agreement.

Navigating the Lease-to-Own Landscape: Trends and Tips

The lease-to-own car market is constantly evolving. Increasingly, online platforms and specialized dealerships are offering these arrangements. It’s important to stay informed about current trends and choose a reputable provider.

In recent years, there’s been a rise of “Rent-to-Own” programs, where you can rent a car with the option to purchase it later. These programs are often aimed at those with limited credit history, but it’s essential to carefully evaluate the terms and costs involved. Be wary of excessively high rental costs or unreasonably high purchase option prices.

Image: templates.rjuuc.edu.np

Expert Advice for Navigating Lease-to-Own Agreements

- Do Your Research: Before entering into any lease-to-own agreement, thoroughly research the dealer or company. Check online reviews, contact the Better Business Bureau, and talk to others who have used their services.

- Read the Contract Meticulously: Avoid any pressure to sign without reading and understanding the entire contract. Make sure you comprehend all the terms, conditions, and financial implications before committing.

- Compare Options: Don’t settle for the first lease-to-own deal you come across. Compare offers from different providers to find the most advantageous terms.

- Negotiate: Don’t be afraid to negotiate with the seller. Try to lower the purchase option price, reduce the lease term, or get a lower overall cost.

- Factor in the Total Cost: Be mindful of the total cost of ownership, which includes the monthly payments, down payment, purchase option price, and any potential fees or charges.

Common Lease-to-Own Contract Questions

Q: Can I get a loan to cover the purchase option price?

A: Yes, once the lease term is complete and you decide to exercise the purchase option, you might be able to get a traditional car loan to cover the remaining balance. Your credit history and the car’s value will play a crucial role in securing this loan.

Q: How does the purchase option price get determined?

A: The purchase option price is often a combination of the car’s depreciated value and the remaining lease payments. It’s important to understand how this price is calculated and if it’s fair based on the car’s market value.

Q: What happens if I default on the lease-to-own agreement?

A: If you default on the lease, the seller can repossess the vehicle. It’s important to understand the consequences of defaulting and to make sure you can meet the financial obligations of the agreement.

Lease To Own Car Contract Template

Conclusion: Making Informed Lease-to-Own Decisions

Lease-to-own car contracts can provide an excellent opportunity to own a vehicle, but it’s crucial to approach them with caution and a thorough understanding of the terms. By navigating the process with knowledge and preparation, you can maximize your chances of finding a favorable agreement. The key is to research thoroughly, compare offers, negotiate effectively, and understand the entire cost of ownership.

Are you considering a lease-to-own car contract? Share your thoughts and experiences in the comments below!