Introduction

Imagine a world without banks. It’s hard to fathom, right? We rely on banks for everything, from saving our hard-earned money to getting a loan for our dream home. But did you know that not all banks are created equal? There are actually different types of banks, each with its own unique purpose and role in the financial system. This can be confusing, especially for someone just starting to learn about finance. This lesson will demystify the complexities of the banking system by highlighting the diverse types of banks that exist and their specific functions.

Image: www.youtube.com

In this lesson, you’ll not only learn about different bank types but also gain valuable insights that can help you choose the best bank for your individual needs. Whether you’re a seasoned investor or a fresh graduate entering the world of finance, understanding the different types of banks is essential for making informed financial decisions. Let’s embark on this journey of financial literacy together!

Types of Banks: Understanding the Financial Landscape

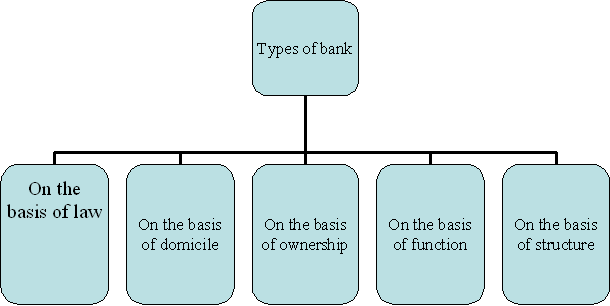

The financial world is like a bustling city, and banks are the towering skyscrapers that house diverse businesses. Each bank type has its own unique function, contributing to the overall economic health of the city. Broadly, we can categorize banks into two main categories:

- Commercial Banks: The everyday banks you’re most familiar with, serving individuals and businesses.

- Non-Commercial Banks: These include a wider range of financial institutions focused on specific niches within the financial system.

Let’s delve deeper into each type, understanding their roles, services, and how they interact to form the backbone of our financial system.”

Commercial Banks: Your Everyday Financial Partners

Commercial banks are the most common type, their name reflecting their primary role: serving businesses and individuals. They offer a broad range of services, making them essential for everyday financial needs. Here’s a breakdown of their core functions:

- Deposits: They accept deposits from individuals and businesses, providing a safe and convenient way to store money.

- Loans: Commercial banks offer loans to individuals for home buying, personal expenses, and businesses for expansion and working capital.

- Payment Services: They facilitate payments through checks, debit cards, wire transfers, and online banking platforms.

- Investment Services: Some commercial banks allow individuals to invest in stocks, bonds, and mutual funds through brokerage accounts.

- Currency Exchange: They provide currency exchange services for international transactions.

Commercial banks play a crucial role in the economy by facilitating business growth, enabling individuals to manage their finances, and acting as a conduit for money circulation.

Non-Commercial Banks: Serving Specialized Financial Needs

While commercial banks cater to a wide spectrum of financial needs, non-commercial banks offer specialized services to specific client segments or industries. These banks can be further divided into:

Image: managementation.com

Investment Banks: The Powerhouses of Capital Markets

Investment banks are the architects of the capital markets. They don’t accept deposits like commercial banks. Instead, they focus on helping businesses raise capital through various financial instruments like equity offerings (selling stocks) and debt financing (issuing bonds).

Credit Unions: A Cooperative Approach to Banking

Credit unions are member-owned, non-profit financial institutions. Their members share common bonds, like employment, residence, or a particular shared interest. They offer many services similar to commercial banks, often with lower fees and more competitive interest rates.

Savings and Loans (S&Ls): Dedicated to Homeownership

S&Ls were originally created to promote homeownership. They primarily specialize in mortgages and related services. Today, many S&Ls have expanded their service offerings to include traditional commercial bank services as well.

Online Banks: Banking at Your Fingertips

Online banks are entirely digital, offering their services through mobile apps and websites. They sometimes offer competitive interest rates and minimal fees due to their lower overhead costs compared to traditional brick-and-mortar banks.

Central Banks: Guardians of the Economy

Central banks are the most powerful entities in the financial system. They are responsible for overseeing the overall financial health of a nation. Examples include the Federal Reserve in the United States and the Bank of England in the UK. They regulate monetary policy, manage interest rates, and ensure the stability of the banking system.

Trends in Banking: The Future of Finance

The banking industry is constantly evolving, driven by technological advancements, changing consumer preferences, and evolving regulatory landscapes. Some key trends include:

- Rise of Fintech: Fintech companies are disrupting traditional banking with innovative solutions, like mobile payments, peer-to-peer lending, and digital investment platforms.

- Open Banking: Open banking promotes data sharing between financial institutions, allowing for customized financial products and services.

- Artificial Intelligence (AI): AI is revolutionizing banking operations, from fraud detection to personalized customer service.

- Sustainable Finance: Banks are increasingly integrating environmental, social, and governance (ESG) principles into their lending and investment practices.

Staying informed about these trends is crucial for anyone interacting with the financial system.

Tips for Choosing the Right Bank

Choosing the right bank can feel overwhelming, but with careful consideration, you can find an institution that aligns with your financial goals. Here are some tips to help you navigate this process:

- Know Your Needs: What services are most important to you? Do you need access to branches, or are online banking options sufficient?

- Compare Options: Research different banks, taking into account interest rates, fees, convenience, and customer service.

- Consider Your Financial Goals: Do you need help managing debt, saving for retirement, or investing? Certain banks might better align with your specific financial aspirations.

- Read Reviews: Look for online reviews and testimonials from current and former customers to gain insights into a bank’s performance and customer service.

- Talk to an Expert: Consult with a financial advisor or banking professional to get personalized advice based on your unique situation.

Remember, choosing the right bank is a crucial step towards managing your finances effectively and achieving your financial goals.

FAQs

- Q: What are the main differences between commercial banks and investment banks?

A: Commercial banks primarily focus on providing everyday banking services to individuals and businesses, while investment banks specialize in helping businesses raise capital through equity offerings and bond issuance. They don’t typically accept deposits. - Q: Are online banks safe?

A: Online banks are generally as safe as traditional banks, especially those insured by the FDIC (Federal Deposit Insurance Corporation) or similar regulatory bodies. However, it’s crucial to ensure the bank is reputable and has strong security measures in place. - Q: What are the benefits of using a credit union?

A: Credit unions are often known for offering lower loan interest rates and fewer fees than commercial banks. They prioritize member satisfaction and prioritize community engagement over profit maximization. - Q: How does the central bank affect my finances?

A: The central bank’s policies like interest rate adjustments can influence interest rates on your loans, savings accounts, and investment returns.

Lesson 6 – Types Of Banks

https://youtube.com/watch?v=udc7d3ootPE

Conclusion

Understanding the different types of banks is essential for navigating the complex world of finance. From everyday commercial banks to specialized non-commercial options, each bank type serves a distinct purpose, contributing to the vitality of the financial system. By understanding their roles and offerings, you can make informed decisions about your banking needs, maximizing your financial well-being.

Are you interested in learning more about a specific type of bank? Let us know in the comments below! We’re here to help you navigate the world of finance with confidence.