Have you ever wondered what it takes to become a bank teller? What kind of questions might you encounter in an interview, or even a pre-employment test? Navigating the world of banking can seem daunting, but it doesn’t have to be. Understanding the common questions and answers associated with bank teller tests can give you a significant edge in securing your dream job.

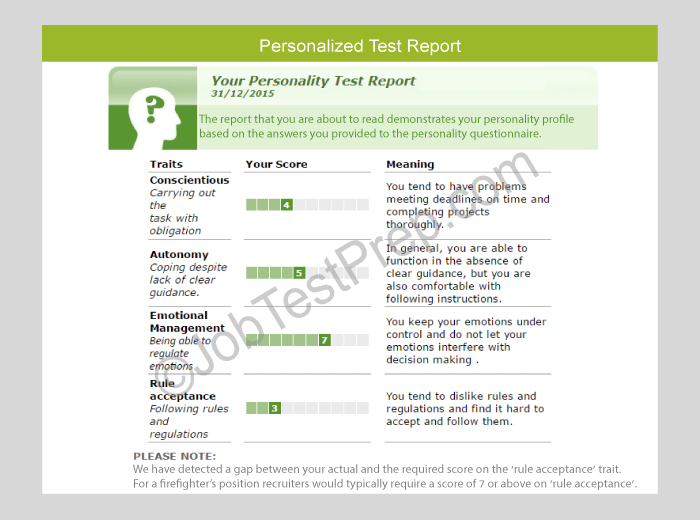

Image: www.jobtestprep.com

This comprehensive guide will equip you with the knowledge and strategies you need to excel in bank teller tests. We’ll explore a variety of question types, provide insightful answers, and offer practical tips for navigating the testing process with confidence.

Understanding the Purpose of Bank Teller Tests

Bank teller tests are designed to assess an individual’s suitability for the demanding role. They often cover a range of skills including:

- Math and Numerical Skills: Bank tellers need to handle cash efficiently and accurately, so expect questions testing your ability with basic arithmetic, counting currency, and calculating interest.

- Customer Service Skills: As the face of the bank, you need to be friendly, patient, and adept at resolving customer inquiries. These tests may involve scenarios or role-playing to judge your communication and problem-solving abilities.

- Attention to Detail: Accuracy is paramount. Expect questions testing your ability to spot errors in transactions, identify discrepancies, and maintain meticulous records.

- Basic Computer Skills: Today’s tellers utilize technology extensively for transactions, account management, and security measures. A basic understanding of computer operations is essential.

- Understanding of Bank Policy and Procedures: The test may assess your knowledge of banking regulations, anti-money laundering procedures, and other security protocols.

By understanding the areas tested and the expectations of employers, you can approach your preparation with focused effort.

Examining Common Bank Teller Test Questions and Answers

Let’s dive into some of the most common question types you might encounter in a bank teller test:

1. Math and Numerical Skills

- Question: A customer deposits a check for $350.75 into an account with a current balance of $125.48. What is the new account balance?

- Answer: $350.75 + $125.48 = $476.23.

This question assesses your ability to perform basic addition, a fundamental skill for handling transactions. It also tests your attention to detail, as you need to account for the decimal point and the proper addition of currency.

Image: www.projectpractical.com

2. Customer Service Skills

- Question: A customer approaches your counter visibly upset, claiming their debit card was declined for an ATM withdrawal. How do you handle this situation?

- Answer: It’s crucial to demonstrate empathy and professionalism. You would first calm the customer down, acknowledging their frustration, and then proceed to investigate the issue. Could there be insufficient funds, a temporary system glitch, or a potential card issue? You would clearly explain the steps being taken and offer potential solutions like checking their account balance, suggesting a telephone helpline, or recommending a call to the card provider.

This question evaluates your ability to handle difficult customer interactions with grace and efficiency.

3. Attention to Detail

- Question: You’re processing a withdrawal for $200. You count out the bills but miss one $20 bill. Do you notice the error?

- Answer: This question tests your ability to be observant and to double-check your work. The correct answer would be “Yes” and to explain that accuracy is paramount in managing cash transactions. You would re-count the bills diligently to ensure the correct amount is given to the customer.

These questions reinforce the importance of double-checking and meticulousness in your work.

4. Understanding of Bank Policy and Procedures

- Question: What are some of the main steps involved in verifying a customer’s identity before processing a transaction?

- Answer: This question highlights the importance of security and compliance. You would demonstrate your knowledge of procedures like:

- Checking a valid government-issued photo ID, such as a driver’s license, passport, or state ID card.

- Comparing the ID against the signature on file for the account.

- Possibly confirming the account details by asking for other personal information.

- Noting any discrepancies and potentially requesting further verification.

The answer demonstrates a strong understanding of essential security protocols.

These sample questions provide a glimpse into the type of challenges you might face.

Strategies for Success in Bank Teller Tests

Preparation is key to conquering any test, and this is especially true for bank teller assessments. Here are some effective strategies:

- Practice Math Skills: Brush up on your basic arithmetic, especially addition, subtraction, and multiplication. You can find practice worksheets online, use math apps, or even just work through simple calculations on a daily basis.

- Understand Bank Policies and Procedures: Research the specific bank’s policies regarding customer identification, handling transactions, security measures, and reporting requirements.

- Sharpen Your Communication Skills: Practice active listening, clear communication, and problem-solving techniques. Engage in role-playing scenarios where you have to handle difficult customer inquiries.

- Test Your Attention to Detail: Pay close attention to small details in your daily routine, spot errors in text, or create a system for checking your own work.

- Familiarize Yourself with Technology: Practice using online banking platforms, ATMs, and other technology commonly used by bank tellers.

- Seek Practice Test Resources: Many online resources offer sample bank teller tests to give you an idea of the testing format and question types. You can find practice tests on websites dedicated to job prep, or in PDF format, providing a valuable opportunity to familiarize yourself with the content and improve your test-taking skills.

Leveraging Bank Teller Test Questions and Answers PDF Resources

Bank teller test questions and answers PDFs can be invaluable tools for your preparation. They provide a structured way to explore common question types, understand the concepts behind the questions, and see examples of well-structured answers. When using a bank teller test questions and answers PDF, it’s important to:

- Understanding the Scope: Ensure the PDF covers a wide range of topics, including math, customer service, security procedures, and general banking knowledge.

- Analyzing Answer Formats: Look at how answers are presented. Are they straightforward, or do they require explanations, justifications, or specific steps to be taken?

- Active Learning: Don’t just read the questions and answers passively. Try to answer the questions independently first, then analyze the provided answers. Identify areas where your understanding is strong and areas that need further review.

- Simulating Test Conditions: Create a test-like environment. Time yourself, maintain focus, and avoid distractions to practice managing your time effectively.

Bank Teller Test Questions And Answers Pdf

Conclusion: Unlocking your Bank Teller Success

Bank teller tests can be a bit intimidating, but by understanding the key areas of assessment, practicing your skills, and utilizing resources like bank teller test questions and answers PDFs, you can significantly enhance your chances of success. Remember that it’s about more than just getting the right answers; it’s about demonstrating your aptitude, readiness, and drive to excel in this challenging but rewarding role. Embrace the opportunity to learn, grow, and showcase your potential. Good luck!