Imagine: you’re managing a bustling business, but your hectic schedule leaves little room for handling everyday banking tasks. You need a reliable team member to help you with these responsibilities, but they lack the authority to manage your company’s bank accounts. Sound familiar? This is where adding an authorized signatory to your bank account becomes crucial. It’s a straightforward process that can streamline your operations and grant your trusted colleague the power to manage financial transactions on your behalf.

Image: www.aplustopper.com

In this comprehensive guide, we’ll delve into the intricacies of writing a request letter to a bank for adding an authorized signatory. From understanding the purpose and process to crafting compelling arguments and ensuring a smooth approval, we’ll equip you with all the knowledge needed for a hassle-free experience. Let’s dive in!

Understanding the Importance of an Authorized Signatory

An authorized signatory, also referred to as a joint account holder, is an individual granted the legal authority to conduct financial transactions on behalf of your business or organization. This empowerment enables them to perform a range of banking tasks, including:

- Depositing funds: Streamlining your cash flow management by allowing another trusted individual to deposit funds into the account.

- Withdrawing funds: Enabling your team member to handle day-to-day expenses and financial obligations as needed.

- Writing checks: Empowering them to make payments and manage your company’s liabilities.

- Transferring funds: Facilitating the movement of funds between accounts or to external beneficiaries.

By appointing an authorized signatory, you effectively delegate essential banking responsibilities. This not only frees up your time for more strategic pursuits but also strengthens your company’s operational efficiency.

Choosing the Right Authorized Signatory

Selecting the appropriate individual to become an authorized signatory is paramount. Consider these essential factors:

1. Trust and Reliability

Above all, choose someone you trust implicitly. This individual must demonstrate integrity, financial responsibility, and the ability to handle sensitive financial information with utmost discretion.

Image: certifyletter.blogspot.com

2. Financial Expertise

Ideally, select someone with some level of financial acumen. While extensive experience isn’t mandatory, basic understanding of banking procedures and financial transactions is beneficial.

3. Communication and Collaboration Skills

An effective authorized signatory needs to be a strong communicator and collaborator. They should be able to effectively coordinate with you and other departments, ensuring seamless management of the account.

4. Availability and Accessibility

Ensure that the chosen individual is readily available to handle urgent banking matters and can respond promptly to your requests.

Crafting a Convincing Request Letter

Now that you’ve selected the ideal authorized signatory, it’s time to craft a compelling request letter to your bank. Here’s a comprehensive guide to ensure your request meets all the necessary criteria:

1. Formal and Clear Formatting

Begin by using a standard business letter format with a professional tone. Your letter should include:

- Your company’s letterhead (with address, contact details, and date)

- The name and address of the branch manager of your bank

- A clear subject line – “Request for Addition of Authorized Signatory” is straightforward and effective.

2. Introduction and Purpose

Start with a concise introduction explaining your company’s purpose for requesting an authorized signatory. Briefly describe your business, the account you wish to modify, and the role the new signatory will play. For instance, you might write:

“Dear [Bank Manager Name],

This letter is to formally request the addition of [Name of New Signatory] as an authorized signatory on our company’s account number [Account Number]. [New Signatory’s Name] is our [Position] and will be responsible for [Brief Description of their Responsibilities].”

3. Details of the New Signatory

Provide detailed information about the individual you’re proposing to add as an authorized signatory. This will include:

- Their full name and address

- Their date of birth

- A copy of their government-issued ID, such as a driver’s license or passport

- Their social security number (this might be needed for verification purposes)

- Their role within your company and a brief explanation of their responsibilities

4. Justifications and Benefits

Clearly articulate the reasons for adding this new signatory and the benefits it will bring to your business. Explain how this addition will streamline your operations, improve efficiency, and contribute to organizational growth. Examples could include:

- Handling daily transactions and freeing up your time for strategic decision-making

- Maintaining uninterrupted cash flow for critical operations

- Improving communication and coordination regarding banking matters

- Ensuring smooth financial management during your absence

5. Verification and Documentation

To ensure smooth processing, you might need to provide additional documents to verify the new signatory’s identity and validate their role within your company. These could include:

- A copy of the current signatory’s authorization document, showing the existing signatories on the account

- A letter of authorization from your company’s managing director or CEO, officially authorizing the new signatory

- Business registration documents, such as a Certificate of Incorporation or Partnership Deed

6. Request for Action

Conclude your request by clearly stating your desired outcome. Ask the bank manager to process your request promptly and inform you of any necessary steps for completing the process. For example:

“We kindly request you to process our request and inform us of the necessary steps and timeframe for the addition of [New Signatory’s Name] as an authorized signatory to our account. We appreciate your prompt attention to this matter.”

7. Formal Closing

End with a professional closing, including your official company name, your signature, and your printed name and title.

Additional Tips for a Successful Request

To maximize your chances of a smooth and prompt approval, consider these additional tips:

- Maintain Professionalism: Use clear, concise language throughout the letter, avoiding jargon or informal expressions.

- Proofread Carefully: Ensure there are no grammatical errors or typos that could reflect negatively on your company.

- Submit in Person: Delivering your request letter in person can expedite the process and provide you with an opportunity to clarify any questions the bank manager may have.

- Follow Up: If you haven’t received a response within a reasonable timeframe, follow up with a polite phone call or email to inquire about the status of your request.

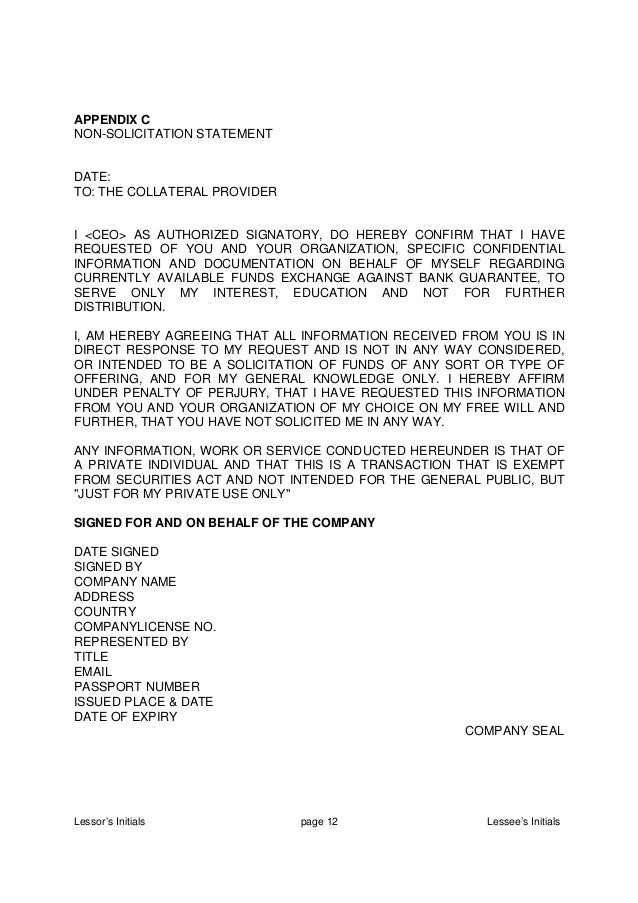

Request Letter To Bank For Adding Authorised Signatory

Conclusion

Adding an authorized signatory to your bank account can be a simple yet impactful step that simplifies your financial management, enhancing your business’s efficiency and empowering your team. By following these guidelines, you’ll be well-equipped to draft a convincing request letter that will lead to a smooth and straightforward approval process. Remember, a well-constructed request letter reflects your company’s professionalism and ensures a seamless experience for both you and your bank.